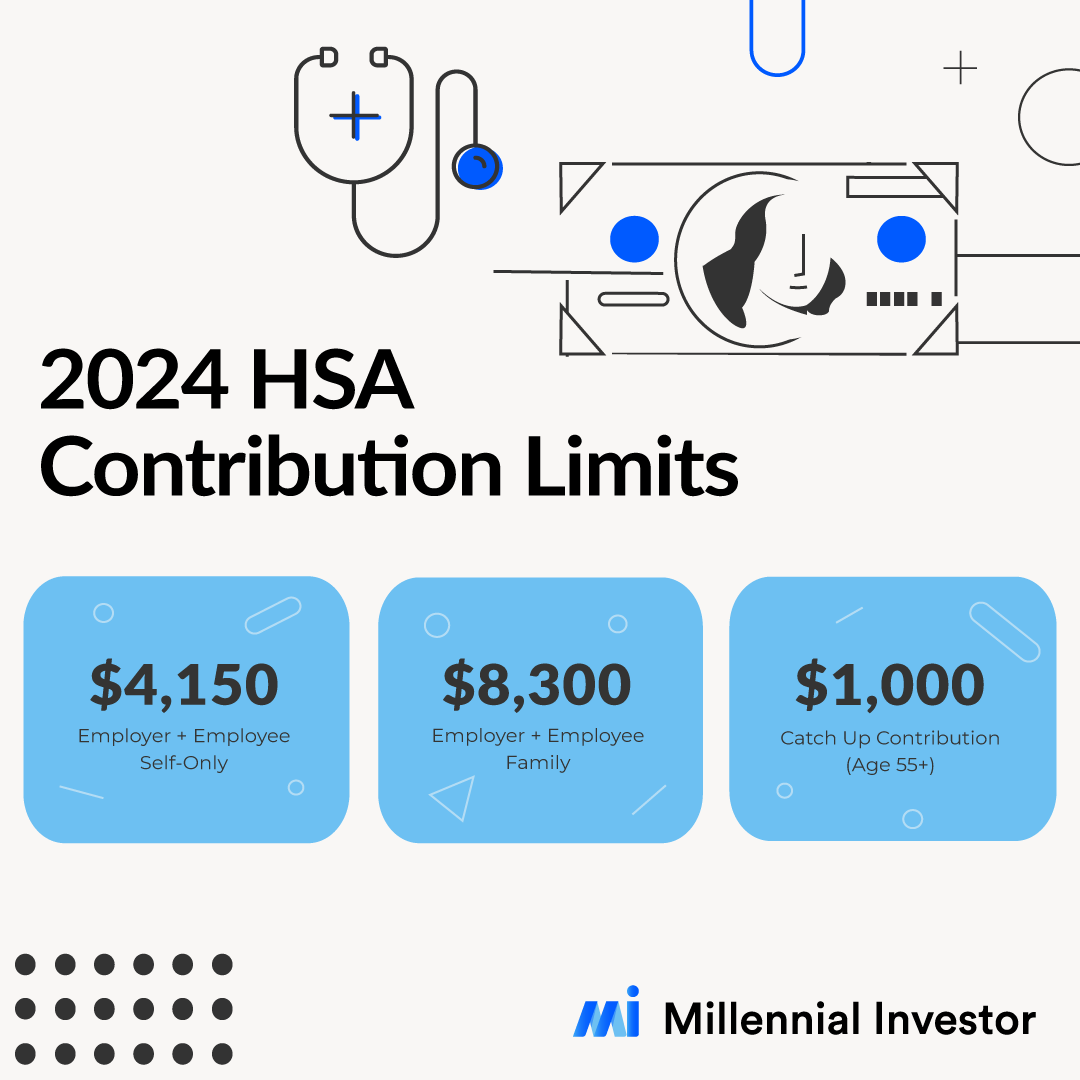

Hsa Contribution Limits 2025 Tax Deduction Under - IRS Makes Historical Increase to 2025 HSA Contribution Limits First, For an individual with family coverage, the amount will be $8,300. Hsa Contribution Limits 2025 Catch Up Over 55 Delora Carmelia, For an individual with family coverage, the amount will be $8,300.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, For an individual with family coverage, the amount will be $8,300.

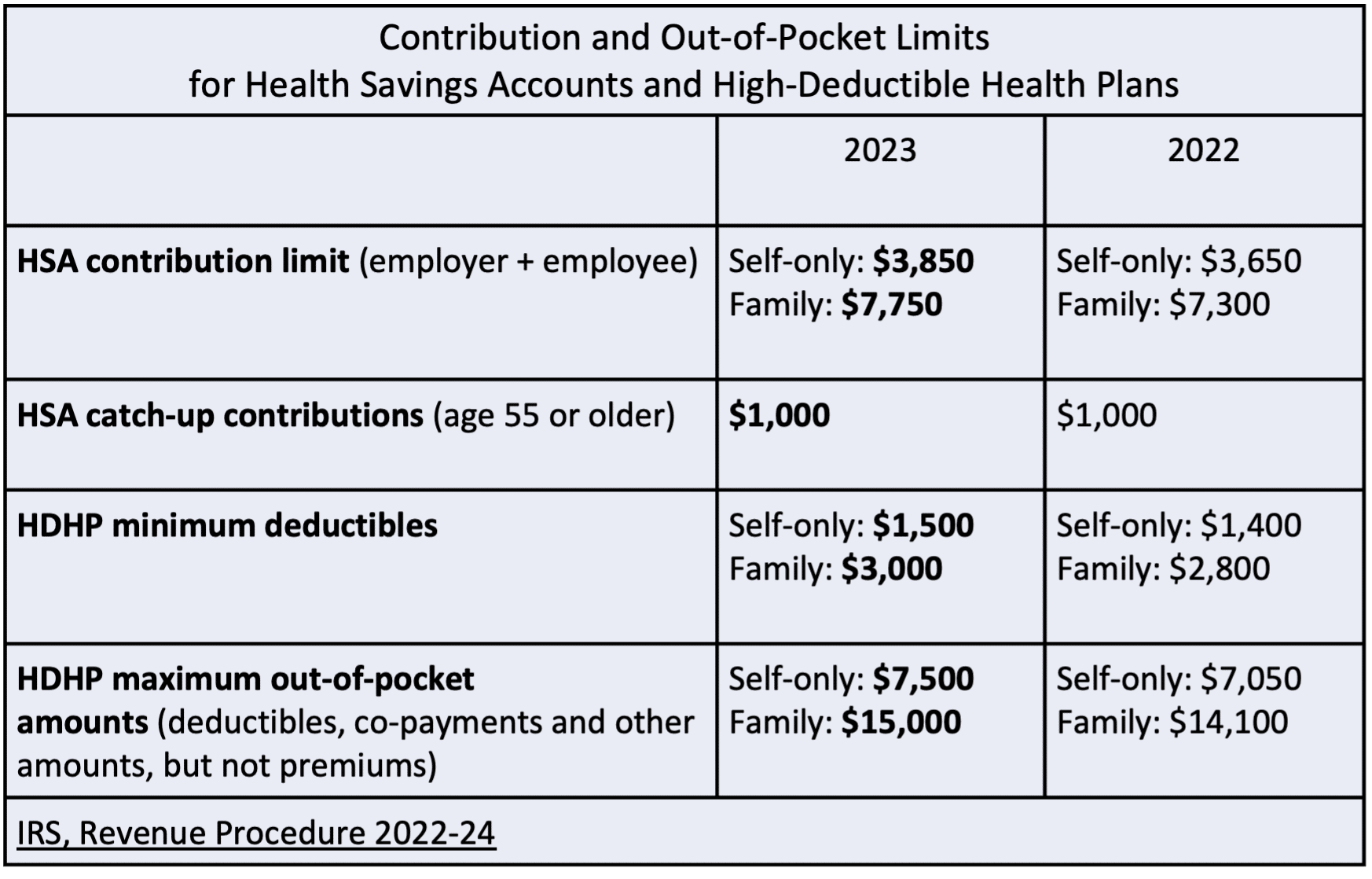

Hsa Contribution Limits 2025 Tax Deduction Under. 2023 hsa contribution limits increase considerably due to inflation, for 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. The health savings account (hsa) contribution limits increased from 2023 to 2025.

Hsa Contribution Limits For 2025 Kelli Melissa, The hsa contribution limits for 2025 are $4,150 for individuals and $8,300 for families.

Irs Guidelines For Hsa 2025 Belva Kittie, The maximum contribution for an hsa in 2025 is $4,150 for an individual (rising to $4,300 for 2025) and $8,300 for a family ($8,600 in 2025).

2025 Irs Limits For Hsa Jenny Carlina, Hsa contribution limits for 2023 are $3,850 for singles and $7,750 for families.

2025 Hsa Limits Explained Variance Norry Daniella, 2023 hsa contribution limits increase considerably due to inflation, for 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

Significant HSA Contribution Limit Increase for 2025, The hsa contribution limit for family coverage is $8,300.

For 2025, you can contribute up to $4,150 if you have individual coverage, up. The hsa contribution limits for 2025 are $4,150 for single individuals and $8,300 for families.

Hsa Limits 2025 Calculator Berri Celeste, If you're under 65 and use the funds for other purposes, that money becomes taxable income,.

HSA Contribution Limits 2023 Millennial Investor, The 2025 contribution limit for health savings accounts (hsas) is $4,150 for individuals and $8,300 for families.